Navigating The 2025 Tax Landscape For Hair Stylists: A Comprehensive Guide To Business Codes And Compliance

Navigating the 2025 Tax Landscape for Hair Stylists: A Comprehensive Guide to Business Codes and Compliance

Related Articles: Navigating the 2025 Tax Landscape for Hair Stylists: A Comprehensive Guide to Business Codes and Compliance

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the 2025 Tax Landscape for Hair Stylists: A Comprehensive Guide to Business Codes and Compliance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Tax Landscape for Hair Stylists: A Comprehensive Guide to Business Codes and Compliance

The year 2025 is fast approaching, and with it, the need for hair stylists to understand the evolving tax landscape. Successfully navigating tax obligations is crucial for the financial health and longevity of any hair styling business, whether it’s a solo operation or a bustling salon. This comprehensive guide explores the key tax business codes relevant to hair stylists in 2025, offering insights into compliance, deductions, and potential pitfalls to avoid. While specific tax laws and codes are subject to change, this article provides a foundation for understanding the general principles and how they apply to the hair styling profession.

Understanding Your Business Structure:

Before diving into specific tax codes, it’s vital to clarify your business structure. Your chosen structure significantly impacts your tax obligations. Common structures for hair stylists include:

-

Sole Proprietorship: This is the simplest structure, where the business and the owner are legally indistinguishable. Profits and losses are reported on the owner’s personal income tax return (Schedule C). This structure offers simplicity but exposes the owner to personal liability for business debts.

-

Partnership: If you operate a salon with one or more partners, a partnership structure is appropriate. Profits and losses are reported on a partnership return (Form 1065), and each partner reports their share of income on their personal return.

-

Limited Liability Company (LLC): An LLC offers the benefits of limited liability, separating personal assets from business debts. The tax treatment of an LLC can vary; it can be taxed as a sole proprietorship, partnership, or corporation depending on the election made with the IRS.

-

S Corporation or C Corporation: These are more complex structures, generally suitable for larger, more established businesses. They offer greater liability protection but involve more stringent regulatory requirements and administrative complexities. For most solo stylists or small salons, these structures are usually unnecessary.

Key Tax Codes and Classifications (2025 Projections):

While specific North American Industry Classification System (NAICS) codes and IRS tax classifications can change, the following provides a general overview of what you might expect in 2025:

-

NAICS Code: Hair stylists will likely fall under NAICS code 812112, "Beauty Salons." This code is used for statistical purposes and helps categorize your business for various government agencies. It’s crucial to use the correct NAICS code when filing tax returns and applying for licenses or permits.

-

IRS Tax Classification: Your IRS tax classification depends on your business structure (as discussed above). Regardless of your structure, you’ll likely be classified as a service provider. This impacts how you report income and claim deductions.

-

State and Local Taxes: In addition to federal taxes, you’ll need to comply with state and local tax regulations, including sales tax (if applicable in your area), professional licensing fees, and potentially unemployment insurance taxes if you employ others.

Important Tax Deductions for Hair Stylists:

Understanding allowable deductions is crucial for minimizing your tax liability. Some key deductions for hair stylists include:

-

Business Expenses: This broad category encompasses many costs associated with running your business, including rent (or mortgage interest if you own the premises), utilities, supplies (hair products, tools, etc.), advertising and marketing expenses, professional development (courses, workshops), and insurance (liability, property). Maintain meticulous records of all expenses.

-

Home Office Deduction: If you operate a portion of your home exclusively and regularly as your business office, you may be eligible for a home office deduction. This deduction allows you to deduct a portion of your home-related expenses, such as mortgage interest, property taxes, utilities, and depreciation. Strict IRS guidelines govern this deduction, so careful record-keeping is essential.

-

Vehicle Expenses: If you use your vehicle for business purposes (traveling to client’s homes, attending industry events), you can deduct expenses related to its use. You can use either the standard mileage rate or the actual expenses method. Accurate mileage logs are crucial for this deduction.

-

Depreciation: The cost of equipment, such as styling chairs, shampoo stations, and other professional tools, can be depreciated over time. This means you can deduct a portion of their cost each year, reducing your taxable income.

-

Self-Employment Tax: As a self-employed individual, you’ll need to pay self-employment taxes, which cover Social Security and Medicare. This is calculated as a percentage of your net earnings from self-employment. You’ll pay both the employer and employee portions of these taxes.

Tax Software and Professional Help:

Managing your taxes effectively requires accurate record-keeping and timely filing. Consider using tax software designed for small businesses or self-employed individuals. These programs can help you calculate your taxes, track expenses, and ensure compliance.

Engaging a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), can provide invaluable assistance. They can help you navigate complex tax laws, optimize your deductions, and ensure you’re compliant with all regulations. This is especially beneficial if you have a more complex business structure or significant income.

Staying Updated on Tax Law Changes:

Tax laws are constantly evolving. Staying informed about changes is critical to ensure your compliance. Regularly check the IRS website and other reputable tax resources for updates and announcements. Consider subscribing to tax newsletters or attending workshops to keep abreast of the latest developments.

Potential Pitfalls to Avoid:

-

Inaccurate Record-Keeping: Meticulous record-keeping is paramount. Maintain detailed records of all income and expenses, including receipts, invoices, and bank statements.

-

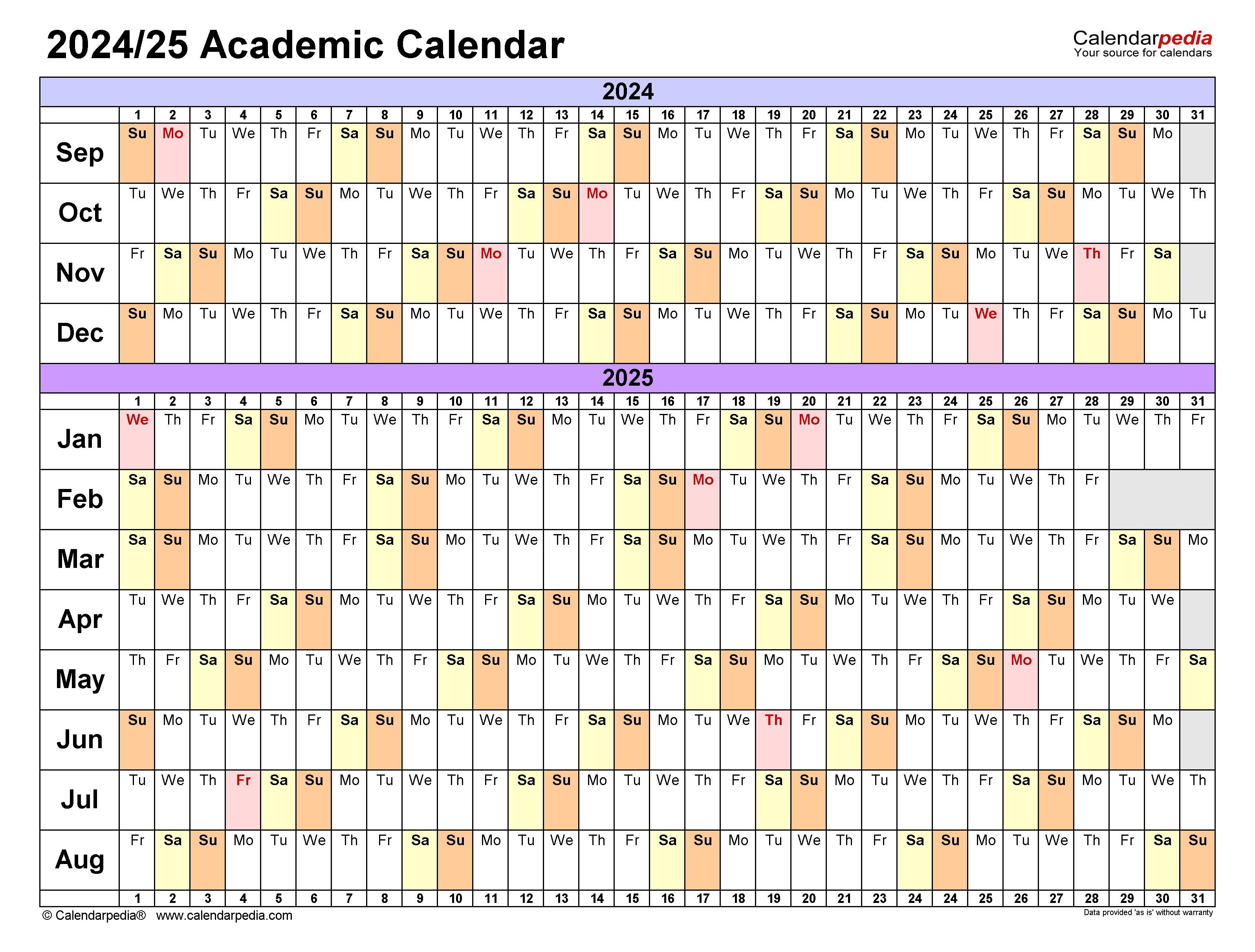

Missing Deadlines: Failing to file your taxes on time can result in penalties and interest charges. Mark tax deadlines on your calendar and plan accordingly.

-

Incorrect Classification: Ensure you’ve correctly classified your business structure and used the appropriate tax codes. Incorrect classification can lead to significant tax problems.

-

Ignoring Deductions: Take advantage of all legitimate deductions to minimize your tax liability. Consult with a tax professional to ensure you don’t miss any potential deductions.

Conclusion:

Successfully navigating the tax landscape as a hair stylist in 2025 requires careful planning, accurate record-keeping, and a good understanding of relevant tax codes and deductions. By understanding your business structure, utilizing appropriate tax software, and seeking professional assistance when needed, you can minimize your tax liability and ensure the financial health of your business. Remember that this article provides general guidance, and it’s crucial to consult with tax professionals for personalized advice based on your specific circumstances and location. Proactive tax planning is an investment in the long-term success of your hair styling business.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Tax Landscape for Hair Stylists: A Comprehensive Guide to Business Codes and Compliance. We hope you find this article informative and beneficial. See you in our next article!