Navigating The 2025 Tax Landscape: A Comprehensive Guide For Self-Employed Hair Stylists

Navigating the 2025 Tax Landscape: A Comprehensive Guide for Self-Employed Hair Stylists

Related Articles: Navigating the 2025 Tax Landscape: A Comprehensive Guide for Self-Employed Hair Stylists

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the 2025 Tax Landscape: A Comprehensive Guide for Self-Employed Hair Stylists. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the 2025 Tax Landscape: A Comprehensive Guide for Self-Employed Hair Stylists

The life of a self-employed hair stylist offers creative freedom and the potential for high earnings, but it also comes with the responsibility of managing your own taxes. Understanding the tax implications is crucial for maximizing your profits and avoiding penalties. While specific tax laws are subject to change, this article provides a comprehensive overview of the key tax considerations for self-employed hair stylists in 2025, anticipating potential adjustments based on current trends and legislation. Remember to consult with a qualified tax professional for personalized advice tailored to your specific circumstances.

I. Understanding Your Tax Status:

As a self-employed hair stylist, you’re considered a sole proprietor or, potentially, a single-member LLC (Limited Liability Company), depending on your business structure. This means you don’t have the same tax withholdings as employees. Instead, you’ll be responsible for paying estimated taxes throughout the year and filing a Schedule C (Profit or Loss from Business) with your Form 1040, U.S. Individual Income Tax Return.

II. Key Tax Deductions for Self-Employed Hair Stylists (2025 Projection):

Claiming all eligible deductions is vital for minimizing your tax liability. Here are some key deductions relevant to self-employed hair stylists, keeping in mind that specific rules and limitations might evolve slightly by 2025:

-

Self-Employment Tax: This is a significant expense for the self-employed. It covers Social Security and Medicare taxes, typically amounting to 15.3% of your net earnings from self-employment (though this could be subject to small adjustments in 2025 based on ongoing Social Security adjustments). You’ll pay half (7.65%) and can deduct the other half as a business expense on your tax return.

-

Home Office Deduction: If you have a dedicated workspace in your home used exclusively and regularly for business, you might be able to deduct a portion of your home expenses, including mortgage interest, rent, utilities, and depreciation. The IRS has specific requirements for qualifying, so meticulous record-keeping is essential. Expect potential minor adjustments to the calculation methods in 2025.

-

Business Expenses: This category encompasses a wide range of deductible expenses directly related to your business. Examples include:

- Supplies: Hair products, color, foils, shampoo, conditioners, etc. Keep detailed records of purchases.

- Equipment: Hair dryers, curling irons, scissors, styling chairs, and other tools. You can depreciate larger equipment over its useful life.

- Rent: If you rent a booth or space in a salon.

- Marketing and Advertising: Business cards, website maintenance, social media advertising, and other promotional expenses.

- Professional Development: Continuing education courses, workshops, and seminars to enhance your skills.

- Insurance: Professional liability insurance (malpractice insurance) is crucial and deductible.

- Travel Expenses: Mileage for business-related travel (client visits, attending industry events), with proper documentation.

- Utilities: Portion of utilities allocated to your business space if you operate from home.

-

Vehicle Expenses: If you use your vehicle for business purposes, you can deduct expenses using either the standard mileage rate (set annually by the IRS) or the actual expenses method (gas, oil, repairs, insurance, depreciation). Careful record-keeping is crucial, including mileage logs.

-

Health Insurance Deduction: Self-employed individuals can deduct the amount they paid for health insurance premiums, subject to certain income limitations. This deduction is particularly beneficial for those without employer-sponsored health insurance.

III. Record Keeping: The Cornerstone of Successful Tax Compliance:

Meticulous record-keeping is paramount for self-employed individuals. The IRS requires you to maintain accurate records of all income and expenses. This includes:

- Income Records: Detailed records of all client payments, including cash, checks, and credit card transactions. Consider using accounting software to streamline this process.

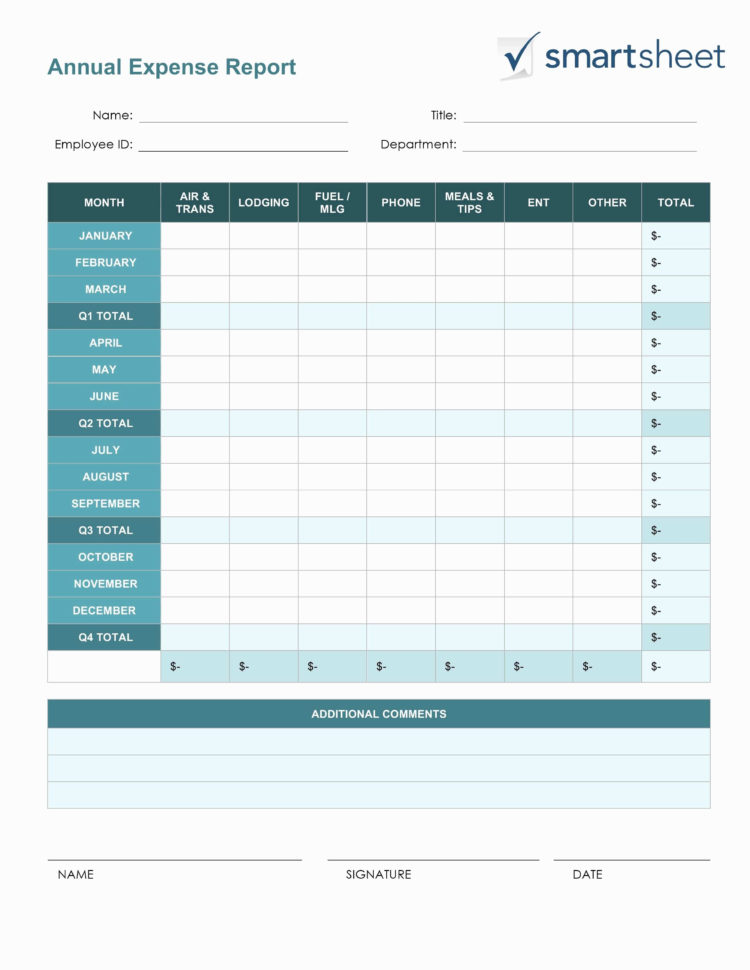

- Expense Records: Receipts, invoices, and bank statements for all business expenses. Organize these records by category for easier tax preparation.

- Mileage Logs: If you use your vehicle for business, maintain a detailed log of your business-related mileage.

- Client Records: Keep records of client appointments and services provided.

IV. Estimated Taxes:

Because taxes aren’t withheld from your income, you’ll need to pay estimated taxes quarterly. This involves calculating your estimated tax liability and making payments to the IRS throughout the year. Underestimating your tax liability can result in penalties. Tools like the IRS’s tax withholding estimator can help you determine your estimated tax obligations.

V. Tax Software and Professional Assistance:

Tax preparation can be complex, especially for self-employed individuals. Consider using tax software designed for the self-employed, or seek professional assistance from a tax accountant or enrolled agent. They can help you navigate the complexities of self-employment taxes, maximize your deductions, and ensure compliance with all relevant tax laws.

VI. Potential Changes in 2025 Tax Laws:

Predicting specific changes in tax laws is challenging, but several factors could influence the 2025 tax landscape for self-employed individuals:

- Inflation Adjustments: Tax brackets, standard deductions, and other thresholds are often adjusted annually for inflation. This will likely affect your tax liability in 2025.

- Tax Legislation: Congress might introduce new tax laws or modify existing ones. Stay informed about any potential changes through reputable sources like the IRS website and financial news outlets.

- Economic Conditions: The overall economic climate can influence tax policy decisions.

VII. Planning for the Future:

Proactive tax planning is crucial for long-term financial success. Consider these strategies:

- Regular Tax Reviews: Schedule regular meetings with a tax professional to review your tax situation and adjust your tax planning strategies as needed.

- Retirement Planning: As a self-employed individual, you’ll need to plan for your retirement independently. Explore options like SEP IRAs, Solo 401(k)s, and other retirement savings plans.

- Business Structure Review: Periodically review your business structure to ensure it’s still the most appropriate for your needs and tax situation.

VIII. Conclusion:

Successfully navigating the tax landscape as a self-employed hair stylist requires diligence, organization, and a thorough understanding of relevant tax laws. By maintaining accurate records, claiming all eligible deductions, and seeking professional assistance when needed, you can minimize your tax liability and focus on building a thriving and sustainable business. Remember that this information is for general guidance only, and it’s crucial to consult with a qualified tax professional for personalized advice tailored to your specific situation in 2025 and beyond. The ever-evolving nature of tax laws necessitates staying informed and proactive in managing your financial obligations.

Closure

Thus, we hope this article has provided valuable insights into Navigating the 2025 Tax Landscape: A Comprehensive Guide for Self-Employed Hair Stylists. We appreciate your attention to our article. See you in our next article!